Accounting Period Editor

Accounting periods are periods of time, typically quarterly, monthly, and annually, on which organizations measure and report their financial performance. Each accounting period is represented by a series of financial statements, generally a profit and loss statement covering the activities during the period and a balance sheet as of the end of the period. Accounting periods also control whether certain transactions or activities are allowed to take place. They should be defined in Projector to correspond with those that exist in the General Ledger system and should cover the same date ranges in both systems.

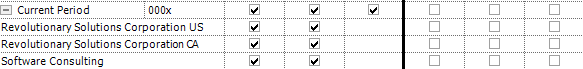

All companies in your installation share the same accounting periods. However, despite sharing date ranges, each company has individual control over whether a period is open.

Additional Resources

- Here is a link to a brief tutorial on Accounting Periods.

- You can watch this webinar Bridging the Gap between Delivery and Finance Teams [Go to 28:30] to watch a quick demonstration on how accounting periods work.

- In the Best Practices: Year End Projector Tasks webinar (25:55) we explain updating Accounting Periods at year end.

- Watch this webinar, Accounting Integration Best Practices, to learn more about best practices around managing accounting periods. (go to 33:49)

The accounting periods editor is reached by going to Administration tab | Job Accounting subsection | Accounting Periods.

Permissions and Settings

To edit accounting periods you must have the global permission Accounting System Interface set to Update.

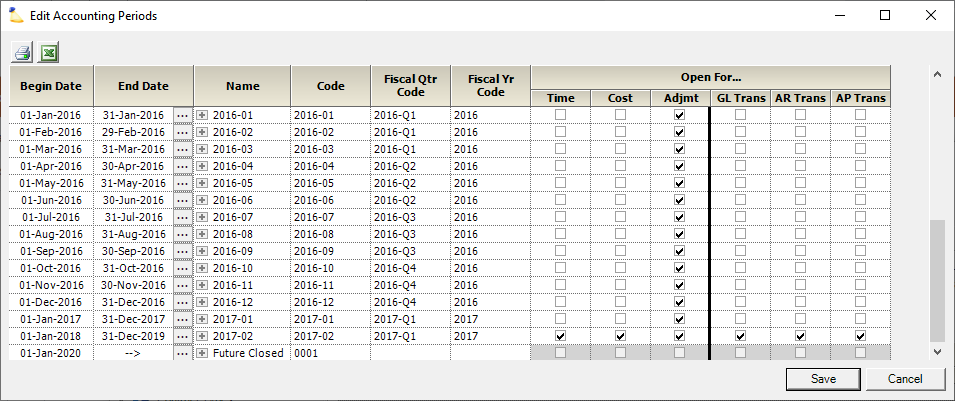

The table below describes what actions are allowed/blocked for an accounting period. Each action is controlled on a per company basis. The Adjustments column is the only column that cannot be adjusted on a per-company basis. It is either open for all companies in an accounting period, or for none.

| Open For | Allows You To |

|---|---|

| Time | Applies to the work date of the time card. Company is derived from the project's cost center.

|

| Cost | Applies to the incurred date of the cost card. Company is derived from the project's cost center.

|

| Adjustment | Applies to time work dates and cost card incurred dates. Many of these are covered in the Time Adjustments and Cost Adjustments help topics. Company is derived from the project's cost center. If the adjustment goes between two companies, for example a transfer, then the originating company must be open for x and the destination company must be open for y.

|

| GL Transaction | You can always create a GL batch, but what that batch contains is driven by whether a period is open for GL. By default, a transaction falls into what we call the "natural" accounting period. For example, revenue from a time card is earned on the date it was worked. If you make a GL batch, it will be for the time card's natural accounting period. If the natural accounting period is closed for GL, then Projector looks forward in time and pushes the transaction into the first, open GL period it finds. If January, Feburary, and March are closed for GL, but a time card is approved in January, then the GL transaction rolls forward to the first open period, April. |

| AR Transaction | Driven by the invoice's Issue Date as defined on the Invoice Editor MP - Invoice Tab

|

| AP Transaction | As driven by the Approved to Pay date on the Payment Voucher

|

Accounting Periods Editor

Projector recommends that you set up a process for handling the open/close of accounting periods. Typically we will see an organization set up their accounting periods ahead of time. For example, creating their next twelve months of accounting periods for the fiscal year. The finance manager then keeps careful track of these periods, keeping them in sync with their accounting package.

!

Edit an existing time period by clicking on the ellipsis for that row and choosing a new end date. Add new time periods by clicking on the last ellipsis for Future. Then tick or untick the checkboxes as appropriate. If your organization has multiple companies, then you can turn Periods on/off for individual companies. Just click the + icon to show additional details.

| Setting | Description |

|---|---|

| Begin/End Date | |

| Name | Give the period a nice name. Although typically you will be using the code. |

| Code | These codes are typically by month or week. We sometimes see alternating 4/5 week schedules. Generally, it's the smallest accounting bucket that you track. Enter an alpha-numeric code to describe the accounting period. We recommend choosing something that sorts nicely during audits. Some other options might be:

Alphabetical Numbers! It's best to choose a naming convention that sorts "alphabetically" even for numbers. For example, use leading zeroes for double digit numbers. If you do not, reporting tools like Excel won't sort properly. For example, 2012-11 will be placed before 2012-2 and we all know November comes after February! |

| Fiscal Qtr Code | Make sure your codes sort "alphabetically" |

| Fiscal Yr Code | Make sure your codes sort "alphabetically" |

| Time | Can time cards be submitted for this date range? |

| Cost | Can expenses be submitted for this date range? This includes expense reports, vendor invoices, and soft costs. |

| Adjmt | Can time/expense amounts be adjusted via Pre-Invoicing Adjustments or Invoice Time Adjustments or Invoice Cost Adjustments |

| GL Trans | Group GL transactions together. The accounting period is determined by the time card's work date or the cost card's incurred date. |

| AR Trans | AR transactions are generated when you issue an invoice. The accounting period is determined by the invoice's Issue Date as defined on the Invoice Editor MP - Invoice Tab. |

| AP Trans | AP transactions are generated when you approve an expense. The accounting period is determined by the payment voucher's Issue Date. |

Split and Merge Accounting Periods

To split or merge an accounting period, make sure you are not in the 'Edit' window. Select an accounting period row. At the bottom of the screen there are options to split merge next and merge previous. You can use the small dropdown arrow to see all choices.

Accounting Transactions

Accounting transactions are automatically assigned a period by Projector. Which period is applied depends on both the transaction type and which periods are open. If a transaction occurs in an open period, then it is assigned that period. If a transaction occurs in a closed period, then the earliest open period AFTER the transaction date is used.

A/R and A/P transactions can be manually remapped to a new accounting period by recalculating the batch or by moving it manually to a new period. G/L transactions are assigned an accounting period when a batch is closed, combined, or recalculated.

Once accounting periods are assigned to individual transactions, the transactions are sent over to your accounting system. Projector sends them via our QuickBooks integration, Dynamics GP integration, or web services.

Projector can process all unsent transactions or just those transactions up to a particular accounting period. Limiting period scope is typically used during the close process. Suppose an organization takes the first few days of February to close out January. If a few transactions slip into the February accounting period, the organization may just want to transmit the January accounting period transactions to the accounting system and hold onto the February transactions until the end of February.