Tax Type Editor

Taxes, everyone's favorite subject. The tax type editor is where you define each tax in your installation. Taxes are applied to time, expenses, and milestones that you invoice. Taxes are applied in the following scenarios:

- All invoices for a specific billing company

- All invoices for a specific client

- Manually applied on a per invoice basis

The tax type editor governs taxes that you collect rather than taxes you paid out, like VAT. If you are interested in learning how Projector handles VAT, please see Value Added Tax (VAT).

Watch Best Practices: Year End Projector Tasks webinar (go to 25:20) for a quick demo on how to update tax types.

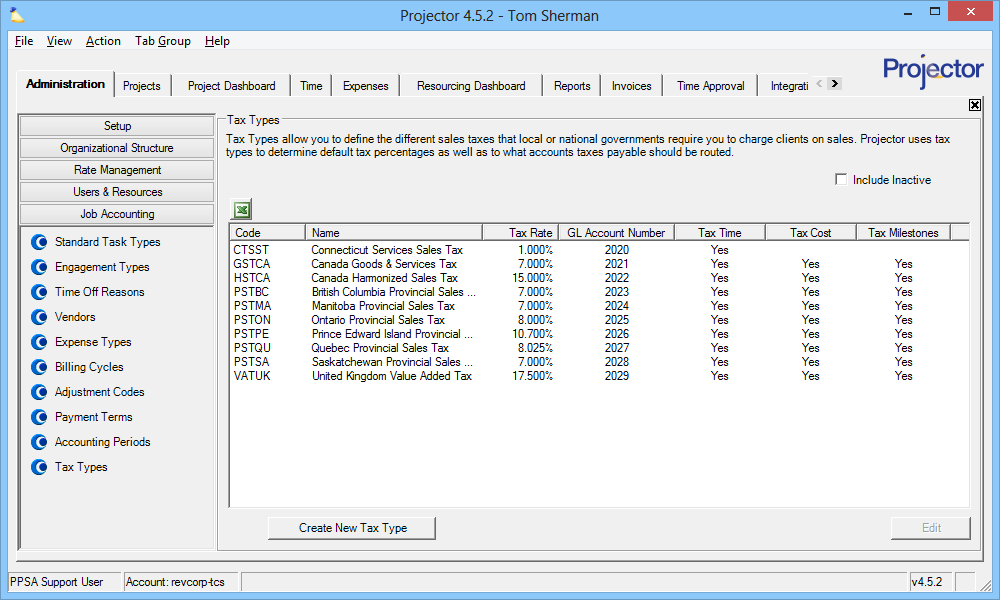

The tax type editor is reached by going to Administration Tab | Job Accounting subsection | Tax Types.

Permissions and Settings

To edit tax types you must have the global permission System Settings set to Update.

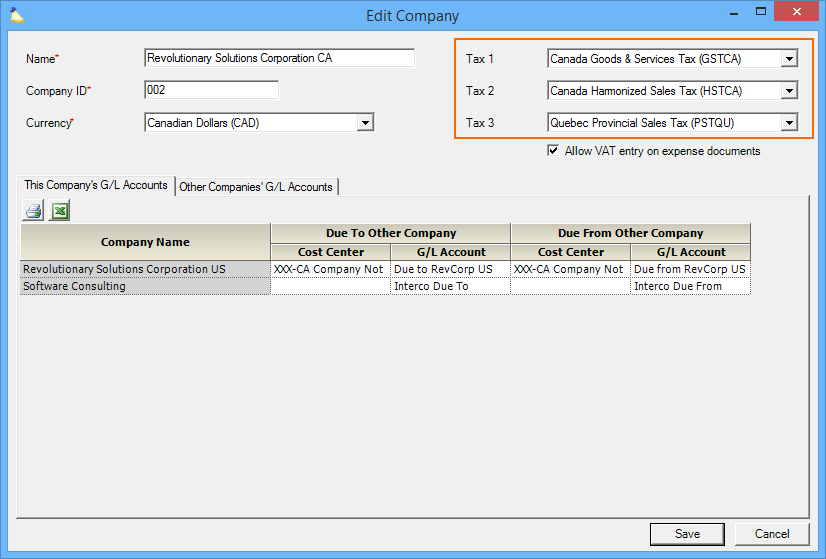

You can define up to three default taxes on new invoices based on the billing company. An invoice is associated with a company based on the billed engagement's cost center.

You can define up to three default taxes on clients too. The client settings override the company settings.

Manage Tax Types

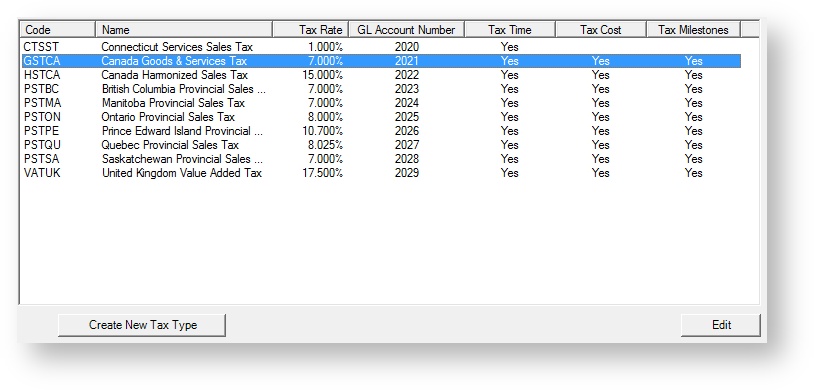

The tax type browser shows all active tax types in your installation. If you wish to see your inactive tax types, tick the Include Inactive checkbox.

Add Tax Type

Click the Create New Tax Type button.

Edit Tax Type

Double click on any tax type

Delete Tax Type

Right click on a tax type and choose Delete Tax Type. A tax type that is currently assigned to a client, engagement, or invoice cannot be deleted. Instead you should inactivate the tax type.

Inactivate Tax Type

Edit the tax type and tick the Inactive checkbox.

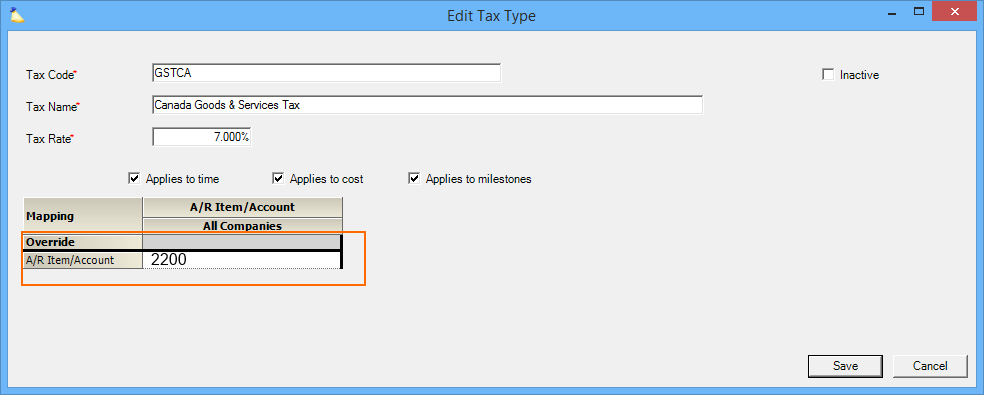

Tax Type Editor

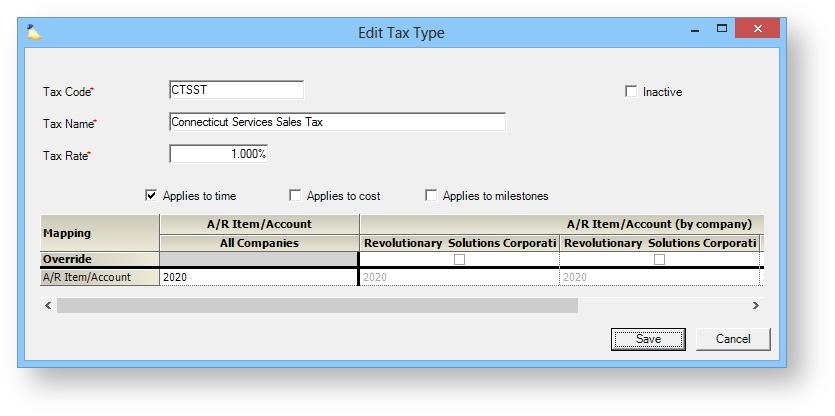

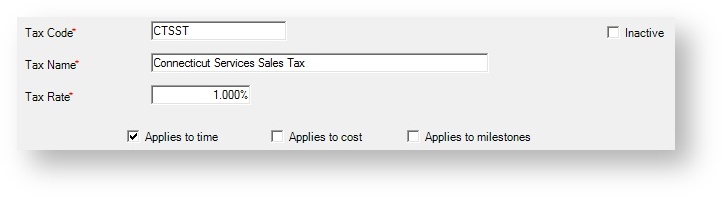

When you start editing a tax type you are presented with this dialog. Each setting is explained in the sections below.

General

See the table for an explanation of each setting.

| Setting | Description |

|---|---|

| Tax Code | Enter up to five characters. The code must be unique. Your users will choose this code when applying their taxes. |

| Tax Name | Enter a descriptive name for this tax |

| Tax Rate | |

| Applies to: | Tick the checkbox for each item that the tax should be applied to

|

| Inactive | Tick the checkbox to make this tax inactive. An inactive tax will continue to exist anywhere it is already set, but will be unavailable for new invoices and edits to existing clients, engagements, and invoices. |

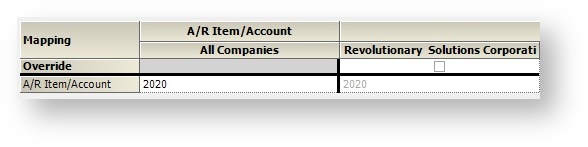

Accounting

Fill in the accounting fields as appropriate for your accounting integration. If you have multiple companies defined in your installation, and have the Enterprise Configuration module enabled, you can map separate charts of accounts for each company.

| Account | Description |

|---|---|

| A/R Item/Account | Collected taxes are accrued in this account |

In Practice

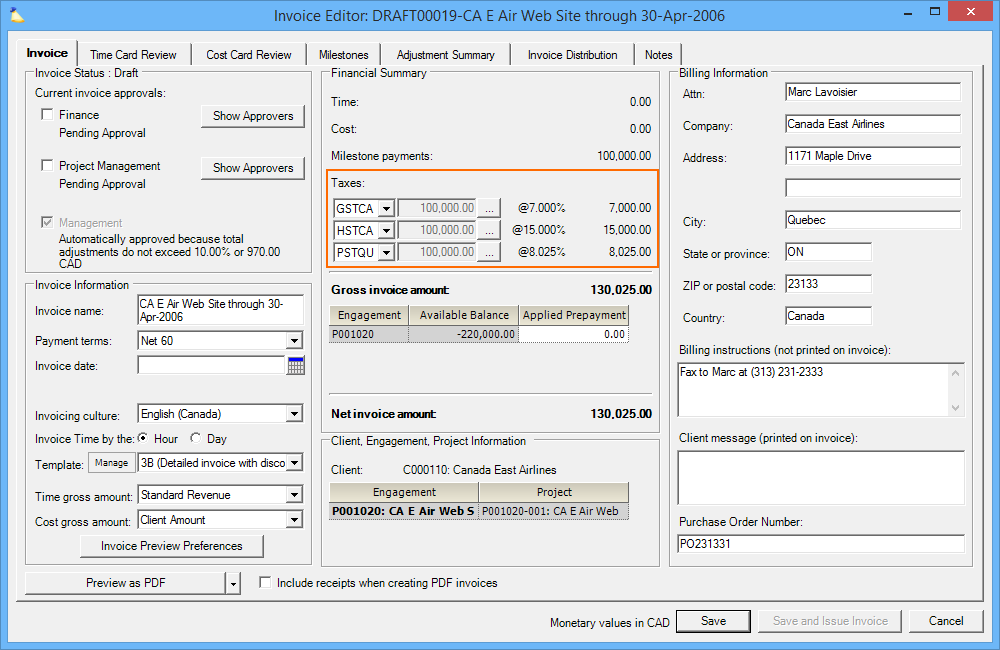

In the screenshot below you can see our Canada based company. There are three default taxes specified to cover time, expenses, and local taxes.

When a new invoice is created against an engagement under this company's umbrella, it prepopulates the taxes and adds them to the invoice total. These can be overridden on a line-item basis.

Finally, when you perform a GL transfer to your accounting package, Projector will track your collected taxes in the indicated accounts.