QuickBooks Sync Accounting Transactions

Projector will transmit pending accounting transactions for the selected period. To view your pending items, visit the AR, AP, and GL sections of Projector. After you have synchronized you should recheck these areas to make sure that your transactions have moved from Pending to Confirmed. You may also want to visit Accounting Period Editor and close periods for accounting transactions as necessary.

Fields imported from Projector may be too long for QuickBooks to handle. In these cases the data will be truncated and you will be warned. To avoid truncation of data please shorten the fields in Projector. You can read more about QuickBook's field limitations in their technical whitepaper.

Field | Character Limit |

|---|---|

Account Name | 31 characters |

Item Name or Number | 31 characters |

Customer Name | 41 characters |

Vendor Name | 41 characters |

Employee First | 41 characters |

Employee Middle | 41 characters |

Employee Last | 41 characters |

| Cost Center Name (including sub-classes) | 158 characte |

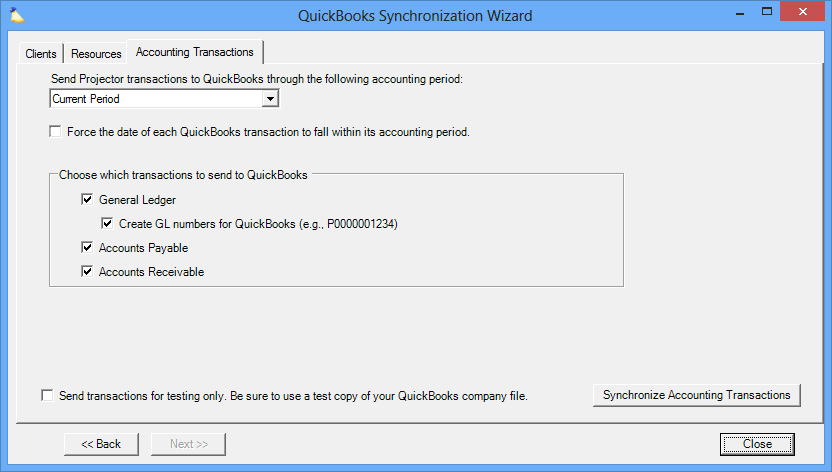

| Field | Description |

|---|---|

| Send Projector transactions to QuickBooks through the following accounting period | Determines the period through which transactions will be sent. Open the drop-down menu to choose the accounting period. Accounting periods for your organization are determined on the Accounting Periods admin form. |

| Force the date of each QuickBooks transaction to fall within its accounting period | This option has been deprecated. It is used to support legacy installations of Projector. Its availability is governed by an account setting. We do not recommend enabling or using this setting as it can cause Projector and QuickBooks to go out of sync. Specifically, this setting forces synced transactions to land in QuickBooks on the day of the sync as opposed to Projector's assigned accounting period. For example, Projector believes a transaction belongs in May. You sync it on June 10. Rather than syncing the transaction to May, it syncs to June 10 instead. This causes problems with reconciliation and audits down the road. Projector reporting says the transaction is in May, but QuickBooks says it is in June. |

| General Ledger |

Create GL numbers for QuickBooks - Create a G/L number that is different than any other G/L number created by Projector for QuickBooks. The format of the number is the letter P (to let you know it was generated by Projector) followed by ten digits |

| Accounts Payable | |

| Accounts Receivable | |

| AR Line Item Tax Code Name (International Edition Only) | This option is only available to QuickBooks Online users. It should only be used if QuickBooks requires a tax code for each line-item on an AR transaction. Please see Business Validation Error: One or more transaction lines do not have a tax code for information on configuring this field and configuring QuickBooks. |

| Send transactions for testing only. Be sure you are using a test copy of your QuickBooks company file. | Checking this is highly recommended when you are sending transactions from Projector to QuickBooks before you have determined that the transactions are being entered properly within QuickBooks. Normally (when this is unchecked) Projector marks its transactions as having already been transmitted to QuickBooks as part of the synchronization process. This prevents QuickBooks from receiving duplicate transactions. |

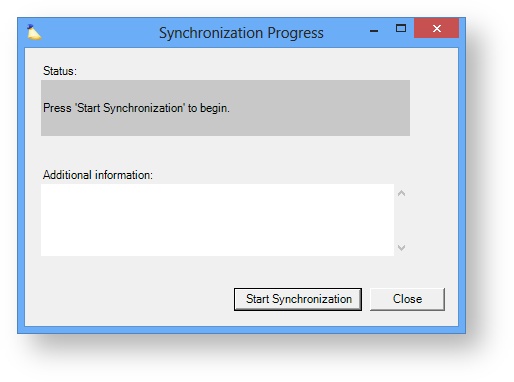

Press the Start Synchonization button to begin transmission of selected data to Quickbooks.

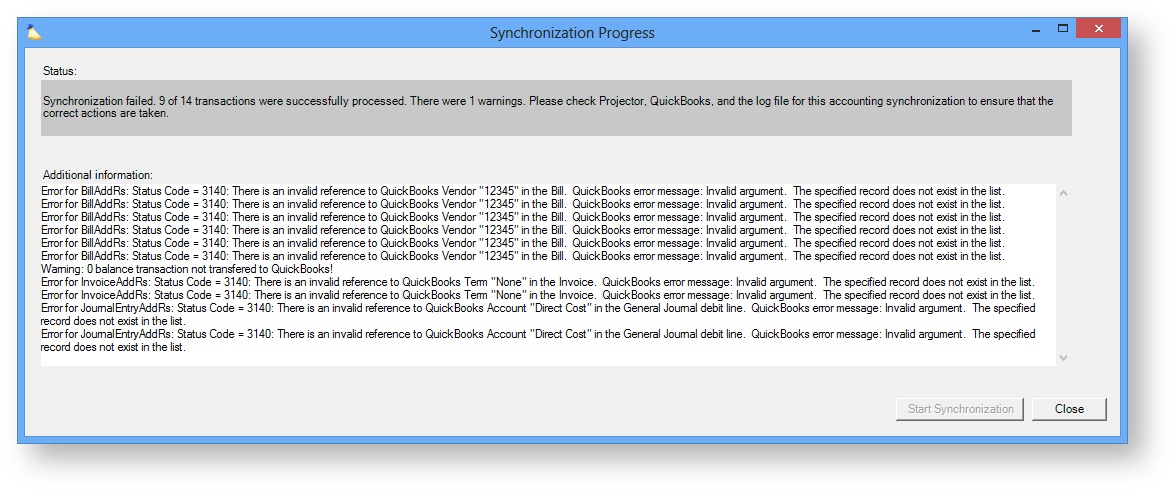

If there are any errors or warnings they will be detailed in the Additional Information area. If you see errors then they are typically caused by either something Projector expects to see in QuickBooks is missing, like an Item, or something in Projector is not properly mapped. You should review the error and attempt to correct the problem on either the Projector or QuickBooks side.