Soft Costs MP

A soft cost is generally used to track expenses that do not have a disbursed amount. That is, there was no fixed outlay from the company for a product or service. For example, you might charge your client $20 a day for printing, but you don't keep track of every page and every ink cartridge used. Or you charge your client a software licensing fee of $5k, but because it is software, there is no real outlay in it's cost.

Some common examples of using soft costs.

Costs billed to a client, but for which a specific disbursement was not made

- Software license fees

- Hosting charges

- Management fees

- Referral fees

Amortize Expense

- Setup a monthly payment to amortize an incurred expense over a period of time

Issuing Credits

- You can use negative soft costs to give a client a credit

This page explains the basics of soft costs, which is a type of expense document. Please see these additional help topics if you don't know what an expense document is.

Permissions and Settings

There are quite a few permissions that affect soft costs. As a soft cost is a type of expense document, you should review that help page so that you understand what higher level permissions inherit down to here.

To create or edit soft costs you must have the cost center permission Maintain Soft Costs.

You find soft costs using the Expense Browser and edit them through the Expense Document Editor.

When you first create a soft cost, you must assign a cost center. This cost center cannot be changed once a cost card moves beyond the draft state. This is to keep approval permissions and accounting transactions consistent throughout the lifecycle of the document. Cost centers can only be changed in Projector Web.

Users that can create soft costs can also edit and approve them. However, Expense approvals are a three step process. To learn more about how to approve expenses, please see the help page Expense Approval.

- Workflow approval - initial approval to allow the card into the system. You cannot approve your own expenses ever.

- Reimbursement approval - the resource or company credit card will be reimbursed for their outlay

- Invoicing approval - the expense may now be pulled onto an invoice and issued to a client

Many settings that affect the workflow of soft costs are available on the System Settings Editor Cost Tab.

- Receipts may be optionally attached to entire soft cost documents or to individual expenses

- Optionally require Locations

- Optionally enter expenses outside of project dates (useful if your sales people incur expenses prior to project work starting)

If you are the same person who creates and approves soft costs, you might want to mark them automatically for repayment and invoicing. You can do this from the System Settings Editor Cost Tab called Automatically approve soft costs.

Manage Soft costs

Soft costs are a versatile tool for handling specific situations in Projector. Here are some examples of how you can use them.

Create

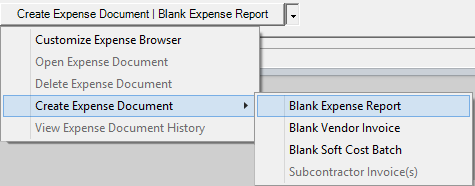

From the expense browser, click the multi-select dropdown and choose Create Expense Document | Blank Soft Cost Batch

Modify

Open any expense document from the expense browser. You can then make changes from the Expense Document Editor.

Delete

Right click an expense report from the expense browser and choose Delete.

In Practice

Some common cases of using Soft Costs

Issue a credit

In the event that you overbill a client, you or the client may be unwilling to void and reissue the original invoice. In this case, you issue a negative soft cost to the client which fixes the accounting side of the problem. If the credit is for time cards, then keep in mind that you will be moving lost revenue from the time side of the equation over to the expense side. Keep in mind this may affect your reporting. If you give bonus' based on average billing rate for time, the billing rates won't be exactly accurate given you have offset some of that time with a cost credit.

Amortize an expense

In the event that you receive a large, up front expense, you may want to amortize it over time. For example,

- Create an initial vendor invoice for $120k

- Approve to pay the $120k, but leave the client amount at $0 and don't invoice it (yet)

- Amortize over the next year by dividing by 12 and setting up soft cost installment charges for months in the future.