Managing Accounting Transactions

Additional Resources

- In the Topic of the Day: Accounting Overview Webinar, we provide a general overview of accounting within Projector and provided examples of some of the most common accounting transactions that Projector generates and can be transmitted over to an accounting system.

- Watch this webinar, Accounting Integration Best Practices, to learn more about managing accounting transactions in Projector (go to 13:26).

This section includes the following topics:

- Transaction Status

- Accounting Periods

- AR Transactions

- AP Transactions

- GL Transactions

- Accounting Transaction Reports

See the chapter on Accounting Integration for additional topics.

Transaction Status

Each transaction has a status of one of the following values:

- Pending – The transaction is ready to be transmitted to the accounting system.

- Transmitted – The transaction has been transmitted to the accounting system, but the accounting system has not yet confirmed receipt. Because most accounting systems will confirm receipt of a transaction immediately, it is rare to see transactions in this state when using an automated interface.

- Confirmed – The transaction has been transmitted to the accounting system and the accounting system has confirmed receipt.

- Void – The transaction will not be transmitted to the accounting system. Transactions can be placed in the Void status manually to, for instance, prevent test transactions from being transmitted. If two offsetting transactions (such as expense report approve and unapprove transactions) are created before transmission to the accounting system, the two transactions will be voided by Projector instead of allowing them to be transmitted.

- Failed – The transaction failed during transmission to the accounting system. In this case, some manual intervention is necessary to correct the reason for the failure and retransmit the transaction.

By setting the transaction status you can control the transmission of the transaction to the accounting system.

See the section on Managing Accounting Transactions for additional information.

Accounting Periods

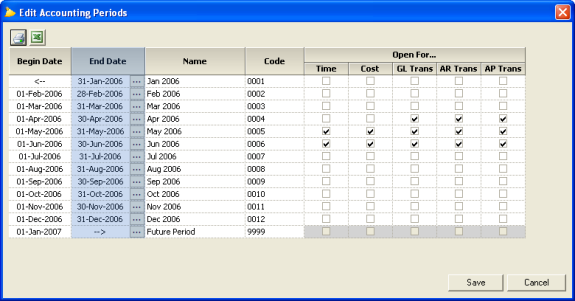

The ability to indicate which accounting periods are open for which types of transactions provides finance with the ability to manage when the transactions affect the P&L and balance sheet. Each accounting period can be open or closed for each of the three accounting transaction types. Accounting periods are managed from the Accounting Periods admin form under the Job Accounting heading of the Administration tab:

The accounting period assigned to a transaction is based on the transaction date and the open/closed status of the accounting period with respect to that type of transaction. The transaction dates for each type of transaction are:

- AR: Invoice date

- AP: Payment voucher date

- GL: Time card work date, cost card incurred date, and reconciliation item's payment voucher date

When Projector assigns an accounting period to a, AP, AR, or GL transaction, it uses the dates described above to find the accounting period it should land in. If that accounting period is closed for that type of transaction, Projector searches forward until it finds the first period open for that type of transaction. If there is no appropriate open accounting period, then the transaction cannot be assigned to a period, and the corresponding action will be prevented.

To manage accounting periods, organizations generally set up accounting periods for an entire year, with one final period (which must be closed for all transactions) representing all time beyond the end of the year. As part of the period closing process, the closed periods should be marked closed for receiving transactions, and a new period should be open if required.

Because some accounting systems (e.g., QuickBooks) determine the accounting period based on the transaction date, Projector's built-in synchronization allows the transaction dates to be modified to fall within the correct accounting period.

See the section on Managing Accounting Transactions for additional information.

AR Transactions

Each time an invoice is issued or voided, an AR transaction is generated. At that time the account mappings are applied, the accounting period is set, and the transaction status is set to Pending. If the mappings or the accounting period are not correct, they should be corrected and the new mappings applied by reapplying mappings to the transaction.

To change the status of an AR transaction, use the icon to the right of status column to launch a status change pop-up dialogue.

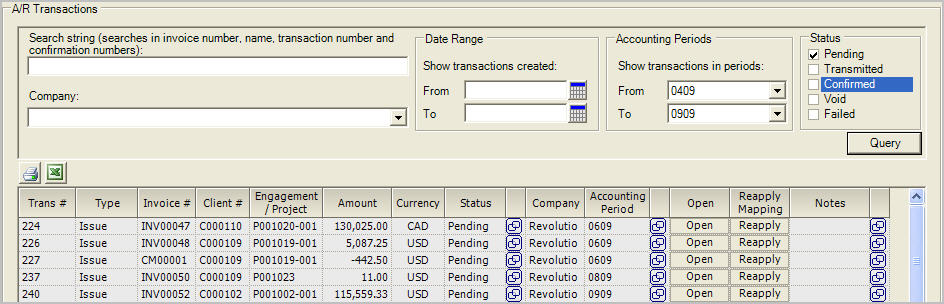

To view the generated transaction, change the transaction status, reapply mappings, or change the accounting period, use the A/R Transactions form, which is located under the Accounting System Integration heading of the Integration tab as shown below. Note that, depending on the accounting system integration, Projector can update the AR transaction with identifying information from the accounting system.

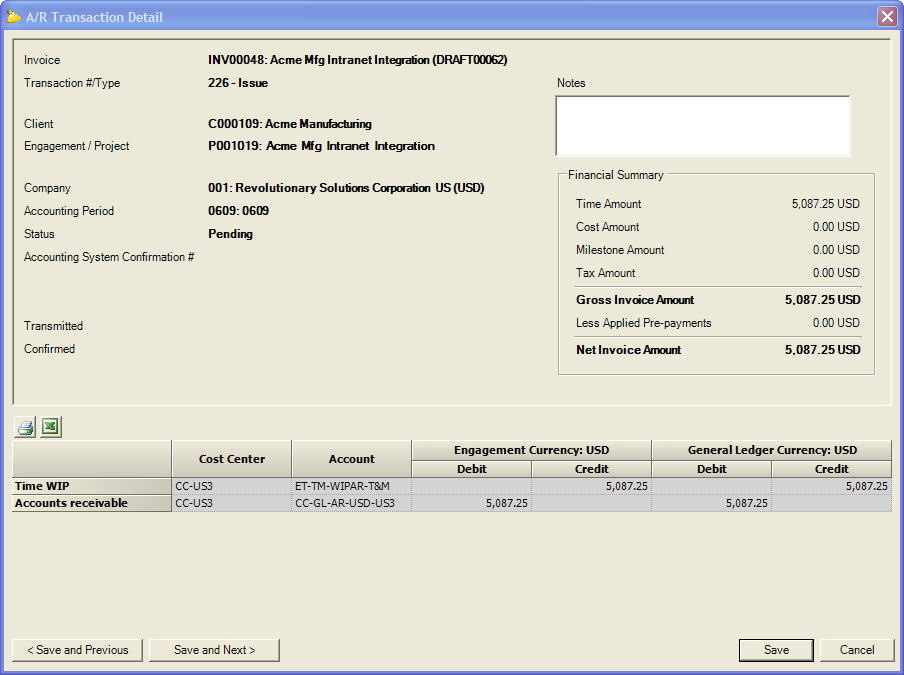

To view the AR transaction in detail, open the transaction. The A/R Transaction Detail form, shown below, shows a summary of the invoice and the AR transaction itself.

See the section on Managing Accounting Transactions for additional information.

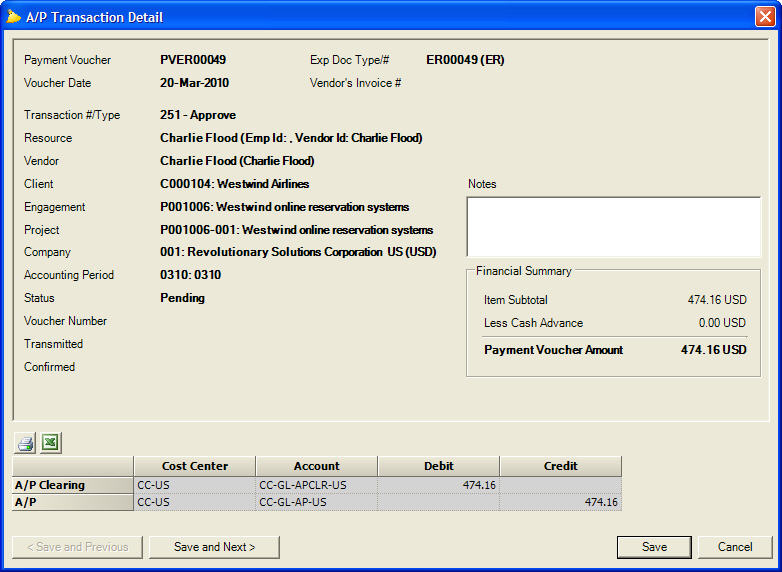

AP Transactions

Each time a payment voucher is approved to pay or unapproved to pay, an AP transaction is generated. At that time the account mappings are applied, the accounting period is set, and the transaction status is set to Pending. If the mappings or the accounting period are not correct, they should be corrected and the new mappings applied by reapplying mappings to the transaction. To change the status of an AP transaction, use the icon to the right of the status column to launch a status change pop up dialogue.

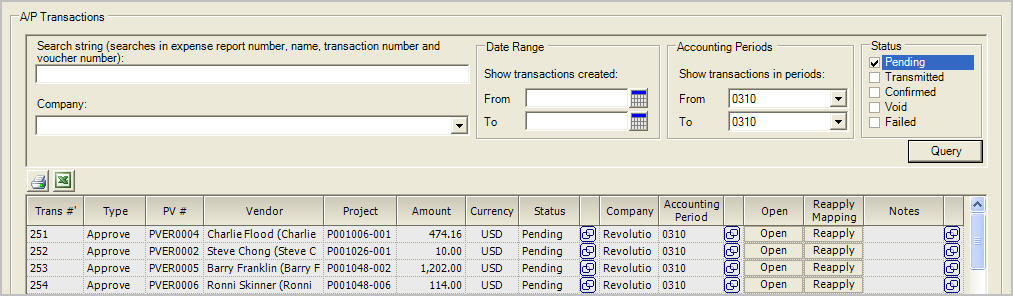

To view the generated transaction, change the transaction status, reapply mappings, or change the accounting period, use the A/P Transactions form, which is located under the Accounting System Integration heading of the Integration tab as shown below. Note that, depending on the accounting system integration, Projector can update the AP transaction with identifying information from the accounting system.

To view the AP transaction in detail, open the transaction. The A/P Transaction Detail form, shown below, shows a summary of the expense report and the AP transaction itself.

See the section on Managing Accounting Transactions for additional information.

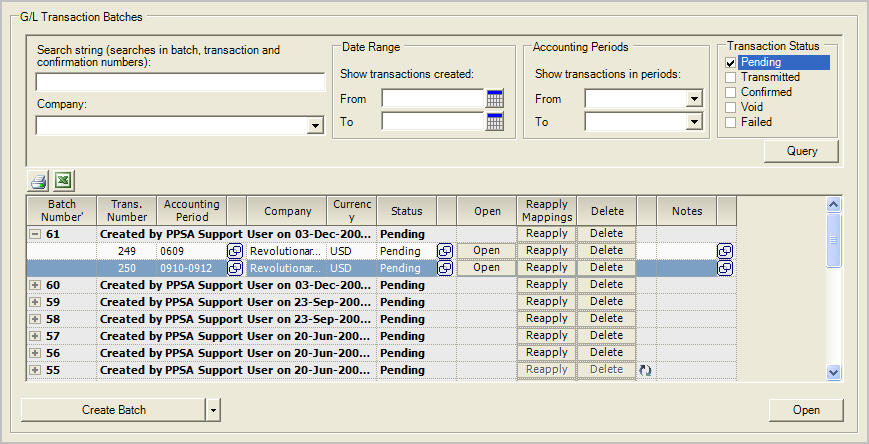

GL Transactions

Actions such as approving or adjusting time and expenses, performing revenue recognition, and entering company-paid costs create GL transactions. Rather than create a huge number of individual GL transactions associated with each time or cost card for each of these events, Projector aggregates the GL transactions into a set of summary transactions. Each time an event creates a GL transaction, the transaction is put in a queue to be processed. In order to generate the aggregated GL transactions for the accounting system, you must create a GL transaction batch.

Creating a GL batch is done from the G/L Transaction Batches form under the Accounting System Integration heading of the Integration tab by clicking on the Create Batch button:

When the batch is created, Projector aggregates all the GL transactions into summary transactions, one for each company and accounting period affected. Since each company's books are in exactly a single currency, this has the effect of keeping each transaction in exactly one currency. At that time, Projector also determines if any intercompany transactions are required and creates them if necessary, applies account mappings, and sets the transactions status to Pending.

If the mappings or the accounting period are not correct, they should be corrected and the new mappings applied. New mappings can be applied at the GL batch or GL transactions level. To change the status of a GL transaction, use the icon to the right of status column to launch a status change pop-up dialogue.

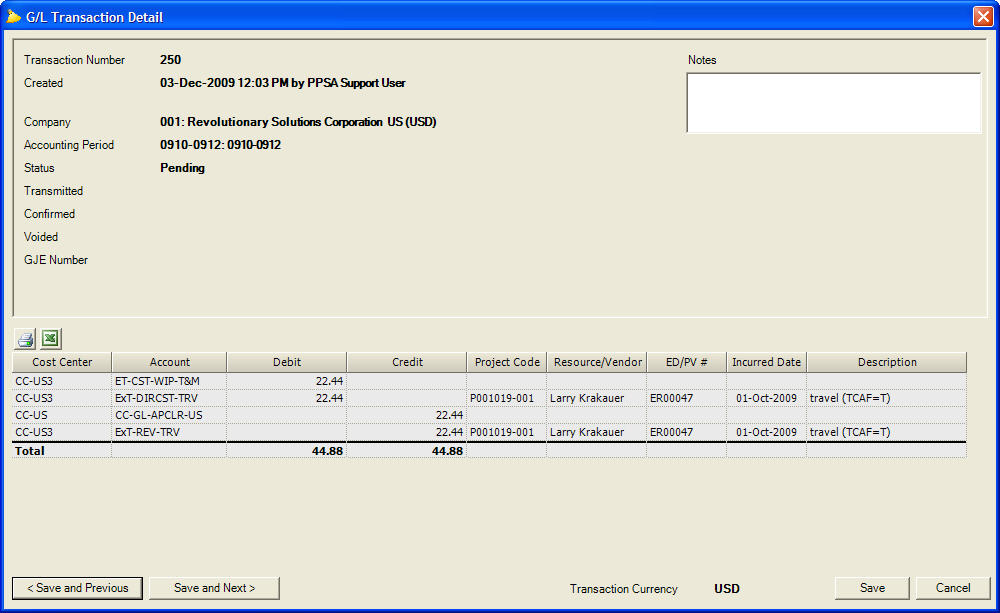

To view a GL transaction in detail, open the transaction. The G/L Transaction Detail form, shown below, shows the individual debits and credits that compose the GL transaction. Note that, depending on the accounting system integration, Projector can update the GJE Number field with the journal entry number from the accounting system.

See the section on Managing Accounting Transactions for additional information.

Transmitting P&L Detail in GL Journal Entries

In the G/L Transaction Detail form shown above, the fourth line (which hits a P&L account) has a debit of $22.44. The debit also shows detail not required by the GL transaction: the project code, resource, expense report number, incurred date, and description. Inclusion of details for P&L accounts prevents aggregation of those GL transactions, resulting in a greater number of transactions being transmitted to the accounting system, but it also permits accounting system users to "drill-down" into the P&L accounts to see what impacted those accounts.

To enable the transmission of P&L detail, open the System Settings form in the Administration tab. Check the box labeled "Transmit P&L detail in journal entries". The setting of the checkbox is applied whenever a GL batch is calculated.

Accounting Transaction Reports

Projector provides several reports that explain transactions and balances for a particular accounting period or GL batch that can be helpful during the period close process, during account reconciliation, or whenever additional detail is needed to explain certain transactions. These include:

Accounting Analysis Report

This report shows all of the accounting transactions and what accounts they hit. The report can be configured to show transactions that have been transmitted to the accounting system (transactions in the confirmed status) or transactions that are waiting to be transmitted (pending status). This report can also provide much more detail than what is actually transmitted to the accounting system, such as revenue by project, which is useful for reconciling Projector with the accounting system.

Accounting Balances Report

This report shows balances in balance sheet accounts as of the end of a particular accounting period. Like the Accounting Analysis Reports, the Balances Reports will provide much more granular detail, such as AP Clearing balances by expense report, to aid with account reconciliation. Also, the report can be configured to show what Projector believes the balances should actually be in the accounting system (confirmed transactions), or what the balances will be after remaining transactions are pushed over (confirmed plus pending transactions).