Accounting Integration Overview

Additional Resources

- Watch this webinar, Accounting Integration Best Practices, to learn the best practices for successfully managing the integration between Projector and an accounting system.

This document provides background information about Projector's accounting transactions and interfacing with accounting systems using Projector's integration tools. Projector is able to act as a complete multi-currency, multi-company job accounting sub-ledger for an accounting system. Within Projector, you can investigate project-specific metrics such as project margin and realized rates. You also use Projector to generate invoices that include details such as individual milestones, time cards, and expenses. The accounting system handles the general ledger, accounts payable, and accounts receivable.

Projector creates three types of transactions --

- Accounts Payable - AP transactions are created when expense reports or vendor invoices are approved for payment

- Accounts Receivable - AR transactions are created when invoices are issued

- General Ledger - GL transactions are created for events that need to post to the general ledger. They are grouped together in batches of data and sent to your accounting package. Projector is used as the accounting sub-ledger. When you need to view the individual events that contribute to a batch, you'll look to Projector for that detail.

Projector does not transmit project-specific data, such as individual time cards, to the accounting system because that data does not need to be posted to the General Ledger, is not needed to pay expense reports, and is not needed to collect payments for invoices.

An organization with offices in several countries will often maintain a different set of books for each country, where the books are in the currency of the respective country. To support this, Projector enables definition of multiple companies. Each company is associated with exactly one currency, and each cost center is associated with exactly one company. When Projector generates accounting transactions, the transactions are identified by company. When transmitting accounting transactions, the company names can be used to ensure that each company's transactions are transmitted to the correct accounting system.

Further topics include:

See the chapter on Accounting Integration for additional topics.

Manual Integration Approaches

The simplest integration mechanisms are manual approaches that require someone to keep data in sync between Projector and the accounting system. Many clients initially integrate the systems by re-keying expense reports and invoices into the accounting system as expense reports are approved and invoices are issued. This is an effective approach when the volume of transactions is low and is an excellent way to become familiar with Projector so that the eventual systematic integration is more successful. This approach requires the smallest investment in terms of set up and process changes.

A second level of integration can be provided by Projector's accounting system reports that provide information about transactions during and account balances as of a particular time period. Information from these reports can be re-keyed, or potentially cut-and-pasted into the accounting system and leverage Projector's accounting system mappings and transaction management capabilities.

See the Accounting Integration Overview for additional topics.

Automated Interfaces

Projector also provides a combination of pre-built and customizable interfaces that allow it to integrate with almost any accounting system. Pre-built interfaces allow Projector to communicate with the accounting system with no custom development and require only some configuration work to integrate the systems. Customizable interfaces are a set of open web services that permit communication with Projector, but require some custom development to allow the accounting system to consume the web services. See the sections below on QuickBooks, Great Plains, and Other Accounting Systems, or see the Accounting Integration Overview for additional topics.

QuickBooks

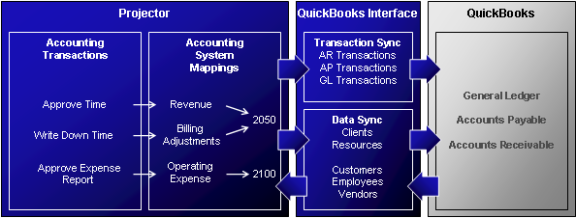

Projector and QuickBooks can share both accounting transactions and data by leveraging a pre-built interface (indicated below with blue arrows):

When activities such as approving time happen within Projector, they create accounting transactions that get queued up for transmission. These transactions are then mapped to QuickBooks accounts using a set of accounting system mappings that are entered into Projector. Once the QuickBooks interface has been installed along with Projector, AR, AP, and GL transactions can be transmitted to QuickBooks Desktop or QuickBooks Online versions. In addition, the systems can share data such as customers, employees, and vendors to help keep the two systems in sync.

The Canadian and UK versions of Quickbooks are able to receive invoices denominated in currencies other than the GL's native currency. Each customer in QuickBooks must be associated with a billing currency, and AR accounts need to be established for each currency. Projector allows mapping to individual AR accounts by currency as well to support multi-currency invoicing in QuickBooks.

Great Plains

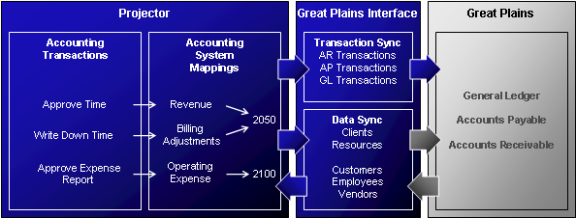

The Great Plains interface is similar to the QuickBooks interface in that transactions can be seamlessly transmitted from Projector without the need to do any custom development. If data synchronization is desired, however, some custom development is required to allow Great Plains to consume pre-built Projector web services that allow export and import of clients and resources (indicated with grey arrows):

Other Accounting Systems

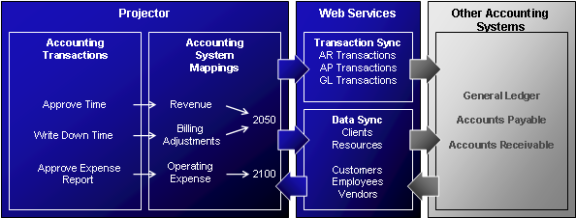

As long as the accounting system has an interface that allows it to programmatically accept data and transactions, Projector's pre-built web services allow automated export of transactions and synchronization of data with the accounting system:

Cost Centers

When Projector maps accounting transactions using the Accounting System Mappings described above, it determines where in the accounting system the transaction should land by determining a cost center and an account. Cost centers allow transactions to land within the proper unit in the organization in the accounting system principally so that the P&Ls for those units can be measured separately and later rolled up as needed. Projector uses attributes of engagements, projects, and resources to determine along with mappings for each cost center to determine where the effect of revenue and expenses land within the P&L. See the Accounting Integration Overview for additional topics.

The account types are as follows:

Account | Account Type | Cost Center Routing | Mapping Location |

|---|---|---|---|

Intercompany Accounts | Asset and Liability | Routed to a single cost center in each company. | Company |

Revenue | Revenue | Time revenue is routed to the engagement's cost center if the Route Profit and Loss Effect for Time is set to Engagement and to the resource's cost center if set to Resource. Similarly, cost revenue and expenses are routed to the engagement's or resource's cost center depending on the Route Profit and Loss Effect for Cost setting on the project. | Cost Center |

Direct Expense | Expense | Routed to the engagement's cost center if the Route Profit and Loss Effect for Cost is set to Engagement and to the resource's cost center if set to Resource. | Cost Center |

Operating Expense | Expense | Routed to the engagement's cost center if the Route Profit and Loss Effect for Cost is set to Engagement and to the resource's cost center if set to Resource. | Cost Center |

Work in Progress | Asset | Routed to the engagement's cost center. | Cost Center |

Accounts Receivable | Asset | Routed to the engagement's cost center. | Cost Center |

Deferred Revenue | Liability | Routed to the engagement's cost center. | Cost Center |

Accounts Payable | Liability | Routed to the disbursing cost center for a payment voucher. | Cost Center |

Cash Advance | Asset | Routed to the cost center the resource belonged to when he or she created the expense report. | Cost Center |

AP Clearing | Contra-liability | Routed to the disbursing cost center for a payment voucher. | Cost Center |

VAT Receivable | Asset | Routed to the cost center the resource belonged to when he or she created the expense report. | Cost Center |

Soft Cost Clearing | Can be any type of account | Routed to the cost center specified in the cost entry screen. | Cost Center |

Vendor Reconciliation | Contra-liability | Routed to the disbursing cost center for a payment voucher | Cost Center |

VAT Payable | Liability | Routed to the engagement's cost center. | Cost Center |

FX Variance | Revenue or Expense | Routed to the engagement's cost center. | Cost Center |

Accounts

Once the proper cost center for a transaction has been determined, Projector determines what account to which the transaction should be routed. In general, Projector impacts three types of accounts:

- Profit and Loss Accounts – Projector pushes transactions to P&L accounts that determine the financial performance of a part of the business during a particular time frame. These accounts may also be affected by other transactions if revenue or expenses are entered into the GL from systems other than Projector (likely especially in the case of Operating Expenses). As such, Projector will be able to explain some, but not all, of the revenue and expenses generated during a particular period.

- Balance Sheet Control Accounts – As the job accounting sub-ledger, Projector manages both debits and credits into certain balance sheet accounts and should be able to explain the balance of those accounts at the end of each accounting period. To aid with the period close account reconciliation process, these accounts generally need to be set up in the accounting system to ensure a starting balance of zero, and transactions outside of Projector should never be allowed to touch these control accounts. These accounts include Time WIP, Cost WIP, and AP Clearing.

- Other Balance Sheet Accounts – Finally, there are several balance sheet accounts to which Projector only sends one "side" of typical transactions, and another sub-ledger or other transactions regularly handle the balancing transactions to those accounts. For instance, when an expense report gets approved to pay with a cash advance on it, Projector will credit the Cash Advance account. If the account didn't get properly debited when the cash advance was disbursed in the first place, the account will have an artificially large credit balance. As such, Projector will be able to explain some, but not all of the transactions that impacted these accounts, and will not by itself be able to explain the balances in these accounts.

To help reconcile the balance sheet accounts, Projector provides reports that show net transactions (Accounting Analysis Report) and ending balances (Accounting Balances Report).

The section Projector Accounting Transactions discusses how transactions are routed to accounts in more detail.

Intercompany Transactions

Projector is a multi-company, multi-currency job accounting system that is able to handle transactions related to incurring expenses in one currency, reimbursing the resource in a second, maintaining a general ledger in a third currency, and billing a client in a fourth. Each cost center whose GL is maintained in a different currency must be set up under a different company within Projector, and each company can have just a single natural currency.

When transactions cross company borders, the debit and credit halves of the transaction may be in different currencies. For these intercompany transactions, Projector uses a set of intercompany accounts that define how much money is owed to and owed from one company to another.

For instance, in the example above, suppose the resource works for the European company, incurs an expense of €10 and expects to be reimbursed in Euro to a project in the US company where the operating expense of $8 will be recorded in US Dollars. To accomplish this, Projector would effectively credit AP in the European company €10 and debit a Due from US company account the same €10. Projector then would credit a Due to European company account $8, and debit the operating expense account $8. When these intercompany accounts, potentially denominated in various currencies, are rolled up during the consolidation process, unearned FX variance accruals may be created due to changes in FX rates over time, a process that happens outside of Projector.