| Excerpt | ||

|---|---|---|

| ||

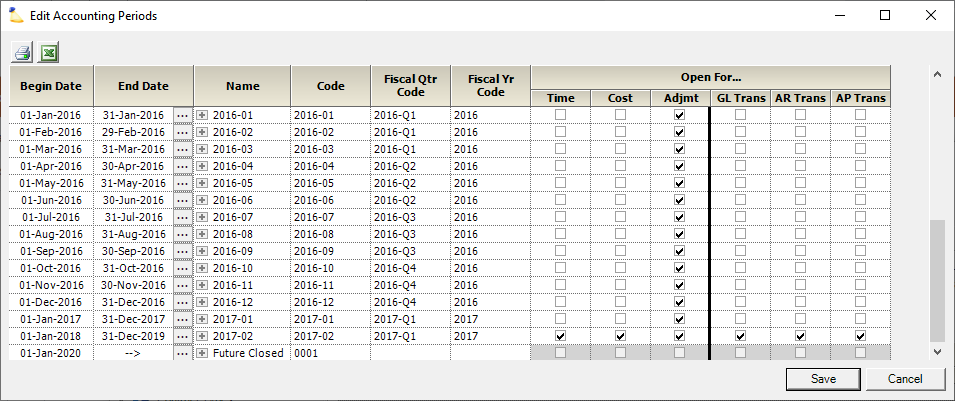

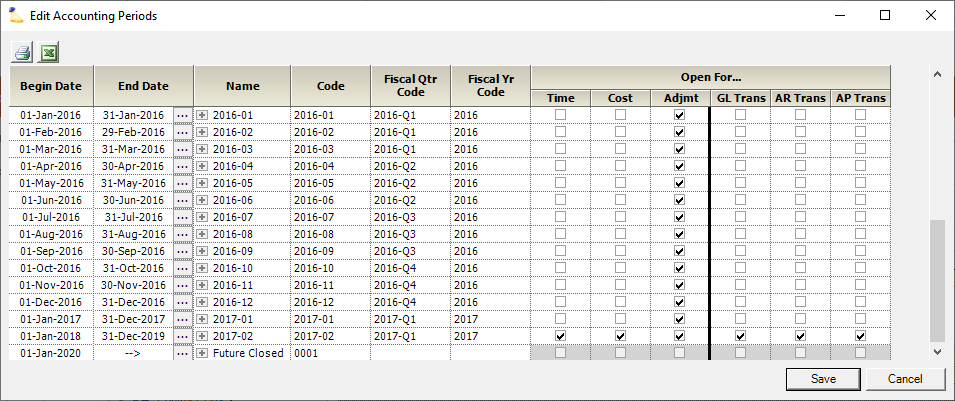

define date ranges that control when time and expense entry/adjustments are allowed as well as group accounting transactions |

...

| Tip | ||

|---|---|---|

| ||

You can watch this webinar Bridging the Gap between Delivery and Finance Teams [Go to 28:30] to watch a quick demonstration on how accounting periods work. In the Best Practices: Year End Projector Tasks webinar (25:55) we explain updating Accounting Periods at year end .Watch this webinar, Accounting Integration Best Practices, to learn more about best practices around managing accounting periods. (go to 33:49) |

The accounting periods editor is reached by going to Administration tab | Job Accounting subsection | Accounting Periods.

Permissions and Settings

...

Projector recommends that you set up a process for handling the open/close of accounting periods. Typically we will see an organization set up their accounting periods ahead of time. For example, creating their next twelve months of accounting periods for the fiscal year. The finance manager then keeps careful track of these periods, keeping them in sync with their accounting package.

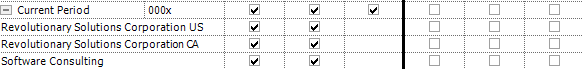

!

Edit an existing time period by clicking on the ellipsis for that row and choosing a new end date. Add new time periods by clicking on the last ellipsis for Future. Then tick or untick the checkboxes as appropriate. If your organization has multiple companies, then you can turn Periods on/off for individual companies. Just click the + icon to show additional details.

| Setting | Description | |||||

|---|---|---|---|---|---|---|

| Begin/End Date | ||||||

| Name | Give the period a nice name. Although typically you will be using the code. | |||||

| Code | These codes are typically by month or week. We sometimes see alternating 4/5 week schedules. Generally, it's the smallest accounting bucket that you track. Enter an alpha-numeric code to describe the accounting period. We recommend choosing something that sorts nicely during audits. Some other options might be:

| |||||

| Fiscal Qtr Code | Make sure your codes sort "alphabetically" | |||||

| Fiscal Yr Code | Make sure your codes sort "alphabetically" | |||||

| Time | Can time cards be submitted for this date range? | |||||

| Cost | Can expenses be submitted for this date range? This includes expense reports, vendor invoices, and soft costs. | |||||

| Adjmt | Can time/expense amounts be adjusted via Pre-Invoicing Adjustments or Invoice Time Adjustments or Invoice Cost Adjustments | |||||

| GL Trans | Group GL transactions together. The accounting period is determined by the time card's work date or the cost card's incurred date. | |||||

| AR Trans | AR transactions are generated when you issue an invoice. The accounting period is determined by the invoice's Issue Date as defined on the Invoice Editor MP - Invoice Tab. | |||||

| AP Trans | AP transactions are generated when you approve an expense. The accounting period is determined by the payment voucher's Issue Date. |

...