If an integration fails because of a bad account mapping you can use this page to look up where corrections need to be made. For example, in the cost center editor.

Company

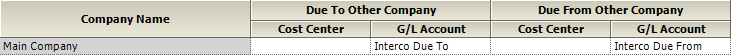

See the Company Editor for more information. The company editor has two tabs. One tab shows This Company's G/L Accounts. The second shows Other Companies' G/L Accounts. These mappings are used for intercompany transactions. For instance, if an employee based in the UK travels to France to work on an engagement owned by the French company, an intercompany transaction needs to occur in order to reimburse that employee for his travel expenses. In this situation, the accounts payable transaction occurs in the UK company in Pounds and an offsetting expense transaction needs to happen in the French company in Euros. To make the transactions balance out, intercompany accounts are used.

This Company

Blank Installation Defaults

Account | Cost Center | G/L Account |

|---|---|---|

Due to Other Company |

| Interco Due To |

Due From Other Company |

| InterCo Due From |

Other Company

Blank Installation Defaults

Account | Cost Center | G/L Account |

|---|---|---|

Due to Other Company |

| Interco Due To |

Due From Other Company |

| InterCo Due From |

Cost Center

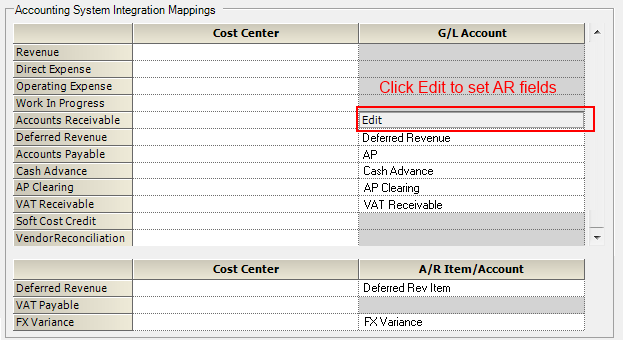

See the Cost Center Editor for more information. Time and expenses are routed through either the project's cost center or the resource's cost center.

Blank Installation Defaults

GL Accounts | Cost Center | GL |

|---|---|---|

Revenue |

| - |

Direct Expense |

| - |

Operating Expense |

| - |

Work in Progress |

| - |

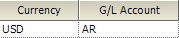

Accounts Receivable |

| Click Edit for additional options

|

Deferred Revenue |

| Deferred Revenue |

Accounts Payable |

| AP |

Cash Advance |

| Cash Advance |

AP Clearing |

| AP Clearing |

VAT Receivable |

| VAT Receivable |

Soft Cost Credit |

| - |

Vendor Reconciliation |

| - |

AR Accounts | Cost Center | GL |

|---|---|---|

Deferred Revenue |

| Deferred Rev Item |

VAT Payable |

| - |

FX Variance |

| FX Variance |

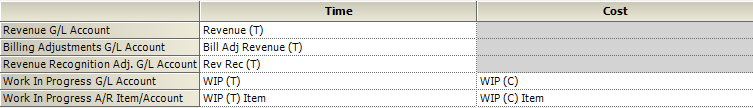

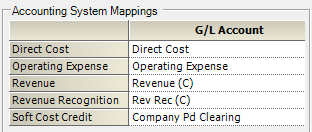

Engagement Type

See the Engagement Type Editor for more information.

Blank Installation Defaults

Account | Time | Cost |

|---|---|---|

Revenue G/L Account | Revenue (T) | - |

Billing Adjustments G/L Account | Bill Adj Revenue (T) | - |

Revenue Recognition Adj. G/L Account | Rev Rec (T) | - |

Work In Progress G/L Account | WIP (T) | WIP (C) |

Work In Progress A/R Item/Account | WIP (T) Item | WIP (C) Item |

Expense Type

See the Expense Type Editor for more detailed information.

Blank Installation Defaults

Account | G/L Account |

|---|---|

Direct Cost | Direct Cost |

Operating Expense | Operating Expense |

Revenue | Revenue |

Revenue Recognition | Revenue Recognition |

Soft Cost Credit | Soft Cost Credit |

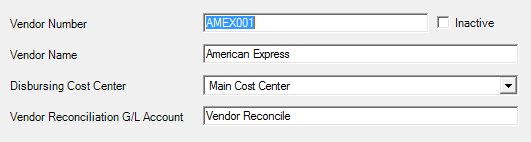

Vendors

See the Vendor Editor for more detailed information.

Blank Installation Defaults

In a blank installation we include vendor AMEX001 by default. This vendor maps to the account Vendor Reconcile. New vendors will map to a blank field.

Account | Vendor Reconciliation G/L Account |

|---|---|

AMEX001 | Vendor Reconcile |

New Vendor |

|

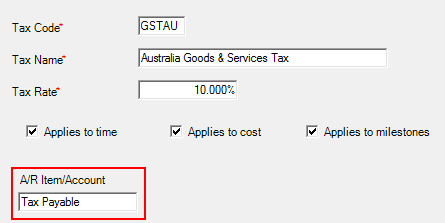

Tax Type

See the Tax Type Editor for more information.

Blank Installation Defaults

Projector includes a number of default taxes.

Account | A/R Item/Account |

|---|---|

Existing | Tax Payable |

New | Tax Payable |