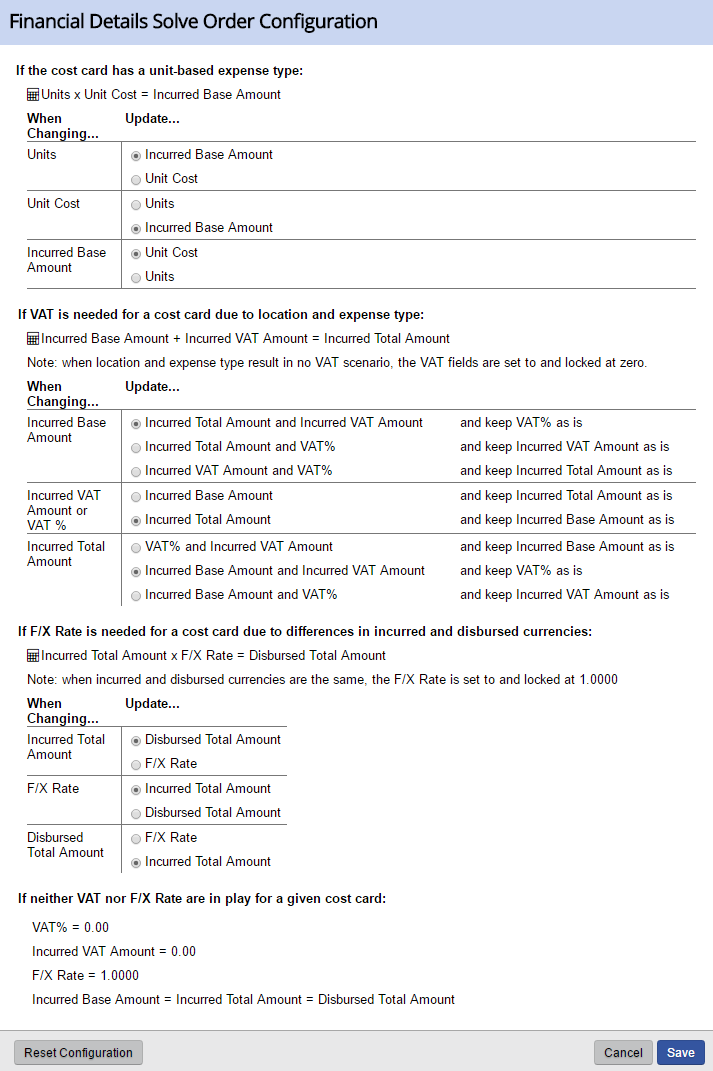

Some financial fields on cost cards involve what we call "three way" relationships. The most familiar example is probably exchange rates between currencies. You have currency one, currency two, and they are linked by the FX rate between them. If you update one field, which of the other two should stay locked while the last changes? The answer is really dependent on the user. This screen allows you to configure the way you want the three-way relationship managed. You are allowed to configure the following:

- Unit-based expenses

- VAT

- FX between currencies

This screen is reached by editing a cost card and clicking the gear icon .

Permissions and Settings

Any user has access to editing cost cards gets access to this setting.

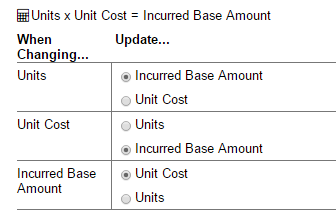

Unit-Based Expenses

Some expense types are unit-based. We often see this for per diem's where a consultant may be authorized a flat $50 per day for travel expenses.

The three-way relationship for unit-based expenses is between Units, Unit Cost, and Incurred Base Amount.

- Units = the number of units purchased

- Unit Cost = the cost of a single unit

- Incurred Base Amount = Units * Unit Cost

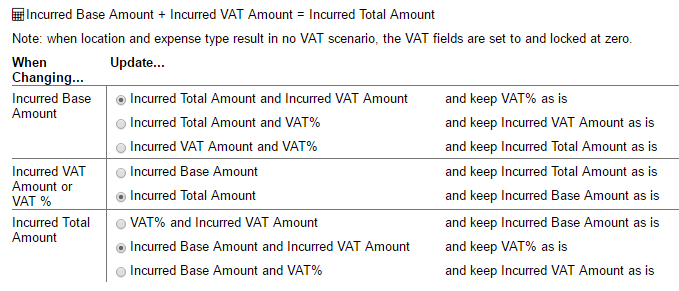

VAT

VAT is actually a bit trickier than just a three-way relationship. There is a fourth player in this relationship, VAT %! In order to keep the number of configurations sane, we always update VAT % whenever one of the other three fields change.

- Incurred Base Amount = the amount you paid for the expense, not including VAT

- Incurred VAT Amount = the amount you paid in VAT

- Incurred Total Amount = Base Amount + VAT Amount

- VAT % = Total Amount / Base Amount

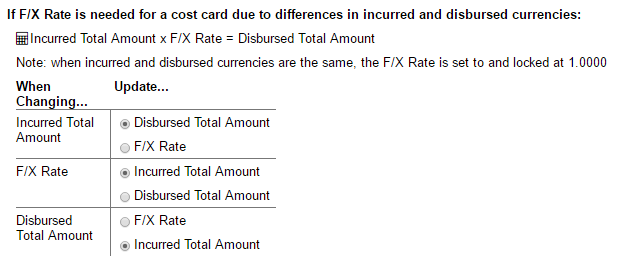

FX Rates

FX rate determines the relationship between the currency the expense was in and the currency you expect to be reimbursed in.

- Incurred Total Amount = the amount you would see on your receipt

- F/X Rate = Disbursed Amount / Incurred Amount

- Disbursed Total Amount = the amount you expect to be reimbursed in your native currency