...

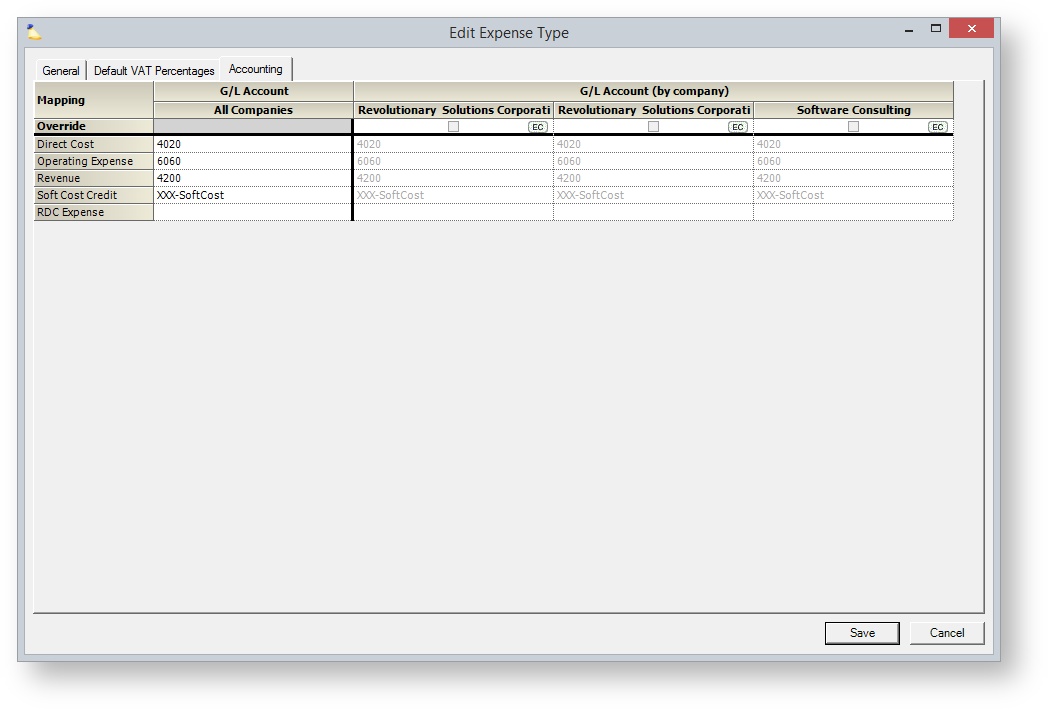

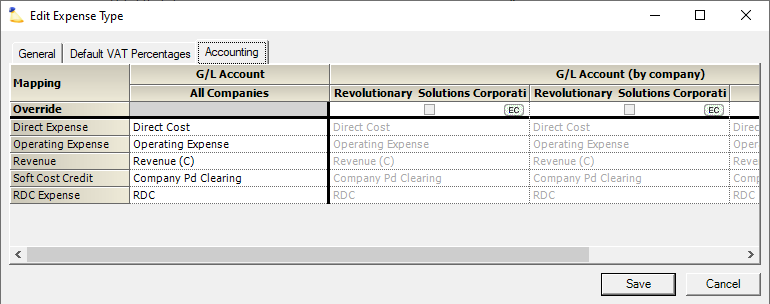

Define key accounts for your expenses of this type. See the table below for an explanation of each. If you have multiple companies defined in your installation, and have the Enterprise Configuration module enabled, you can map separate charts of accounts for each company.

GL Account Mappings | |

|---|---|

Direct CostExpense | Direct Cost Expense is incurred when an expense on a billable engagement is not charged to a client. |

Operating Expense | Operating expense Expense is incurred when an expense is on a non-billable engagement. |

Revenue | Enter the account to which revenue generated by billable work or reimbursed direct costs should be mapped. |

Revenue Recognition | Enter the account to which revenue recognition adjustments for costs should be mapped for this expense type. Revenue recognition adjustments are created when actual and projected contract revenues don't exactly match the caps in time and materials with a cap or fixed price engagements. |

Soft Cost Credit | Enter the account to which soft credits should be mapped. Soft cost credits are the amounts that defray the expenses an organization incurs to support infrastructure such as photocopying equipment or telephones. |

| RDC Expense | Enter the account to which RDC cards should be mapped. An RDC card is used with subcontractor invoices. Think of it as money you pay to a subcontractor or subcontracting vendor. |

...