VAT stands for Value Added Tax. It is a consumption tax placed on goods and services. VAT is assessed at each stage of a product's development, so it is important that you track both the VAT you have paid out and the VAT you have collected. The difference is sent to the government. This page explains the collected side of the equation. Collected VAT is applied during your invoicing process. VAT can optionally be applied to any combination of time, expense, and milestones. Read on to learn how to define default VAT tax rates and add VAT to your invoices. If you are unfamiliar with VAT and need an introduction please read our introductory VAT page.

Permissions and Settings

To start collecting VAT on invoices you need two sets of permissions. The first permission is to define taxes on the Tax Type Editor. For this you need the global permission System Settings set to Update.

The second permission is to add the tax to an invoice. Anyone who can edit an invoice can add the taxes.

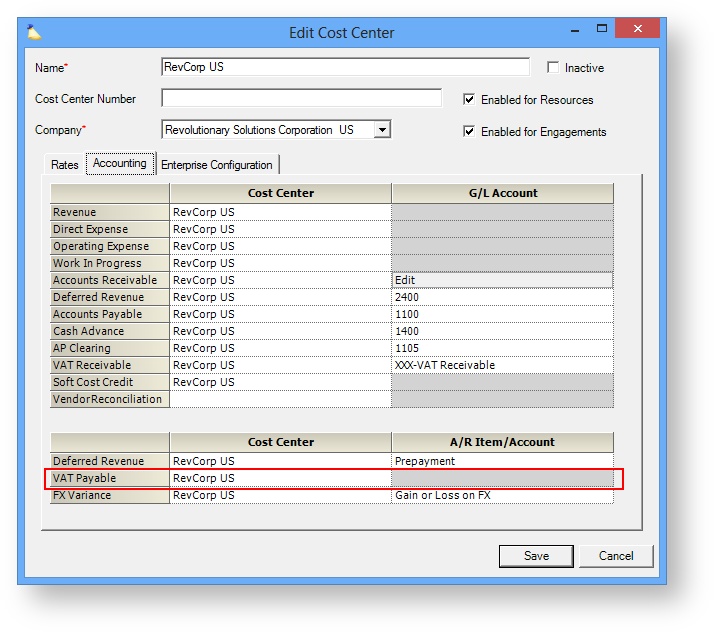

VAT collected hits the VAT Payable account of the engagement's cost center.

Tax Type Editor

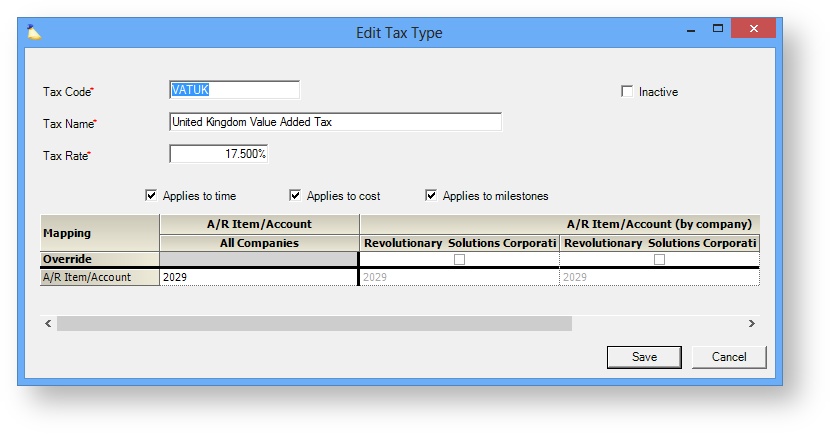

The tax type editor is reached from the Administration tab | Job Accounting subsection | Tax Types section. In the screenshot below you can see that I have defined a VAT entry for the United Kingdom. I have chosen to apply the VAT to time, cost, and milestones equally. You can edit your taxes to affect as many billable items as makes sense for your installation. I have also specified an A/R Item/Account value. When you integrate with an accounting package, this is where you can view your collected VAT totals.

Set up each VAT in the tax type editor and then proceed to the next section of this help page.

Invoice Editor

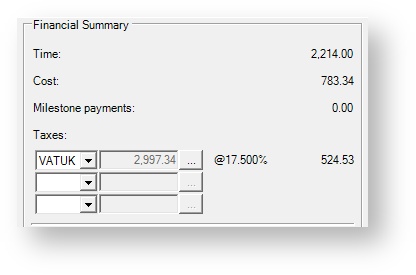

Now that you have your tax types set up, it is time to apply them to your invoices. Start by opening an existing invoice. In the Invoice tab, you can apply up to three taxes.

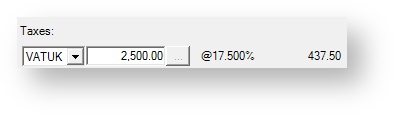

If you need to manually adjust the taxable amount, click the ellipsis button and key in a new value.

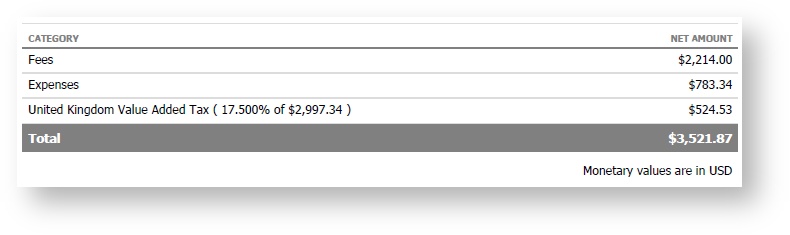

When you issue your invoice, the client will see the VAT line item.

Prepayments

When you have a prepayment and need to account for VAT, it is important to have a repeatable and consistent process that you follow. Reason being, if you don't keep track of VAT properly you could end up collecting too much VAT or not enough VAT. Tax rules vary from country to country, so please don't consider this a definitive guide to invoicing for VAT, but use it as starting point for understanding what things you'll need to take into consideration.

VAT is often not collected on prepayments - reason being, you haven't delivered any goods or services yet. As such, it would be premature to collect tax. A great analogy is a gift card to your favorite store. When you buy a €50 gift card, you don't pay tax on it. When you actually use the gift card, you'll pay taxes on what you purchased. Whether you choose to follow that model is up to you.

Below, please find a few simple examples of how you might collect VAT for a prepayments. Let's assume a 10k prepayment and 2k of VAT.

| Prepayment Scenario | Description | Prepayment Invoice | Real Invoice |

|---|---|---|---|

| No VAT | Don't collect VAT on the prepayment and instead collect it on your real invoice | €10k prepayment | Invoice for €10k of time and cost, client receives an invoice for €2k VAT |

| Prepay VAT | Increase your prepayment amount to account for VAT, but don't actually apply VAT | €12k prepayment | Invoice for €10k of time and cost, €2k of VAT, and consume the entire prepayment. Client owes nothing. |

| Collect VAT | If you do choose to collect VAT up front, you'll need to account for this on the real invoice. | €10k prepayment + €2k VAT | Invoice for €10k of time and cost and no VAT. Client owes nothing. |

The above examples are very much simplified and assume that you charge the client the exact prepayment amount. If you should come under the prepayment amount, or go over the prepayment amount, you'll need to account for this on your invoices. For example, you collect €2k of VAT for €10k of work, but you end up doing €20k of work. Did you collect the proper amount of VAT on the extra work?

Accounting

Part of using VAT is keeping track of how much VAT you have collected. You then compare this number to the amount of VAT you paid out and send the difference to the appropriate government. Or, if VAT is reimbursable, you can request the government send you a check for the amount of VAT you paid out.

Projector tracks collected VAT at the cost center level with the field VAT Payable. VAT is allocated to this account when an invoice is issued. It is then pushed to your accounting software as a GL entry. The cost center is determined by the engagement's cost center.