| Excerpt | ||

|---|---|---|

| ||

manage entities with distinct GL accounts, different currencies, and default taxes |

| Info |

|---|

Companies represent those entities within the organization that keep distinct financial records, report to different taxing authorities, or maintain their books in different base currencies. A currency is identified for each company and represents the currency in which the company's books are kept as well as the currency in which its employees are paid. You would likely add companies to this list if you acquired another business, opened a new office that keeps its own set of books, or opened an office in a new location where the resources are reimbursed in a new currency. If you haven't figured it out already, your accounting system and financial transactions are an integral part of understanding companies. Transactions are ultimately mapped to each company based on the cost centers that belong to it. When a transaction crosses companies, for example if a UK resource works on a US project, Projector creates an intercompany transaction so that the revenue and cost lands on the correct set of books. If this transaction crosses currencies then Projector will FX it. You will need to define accounts between each individual company and every other company defined in your installation to map these transactions. As the number of companies grows the number of accounts you must define increases geometrically. To circumvent this you can optionally specify a Master Company. A master company forces all intercompany transactions through it. This simplifies the number of intercompany mappings that need to be configured. In this setup transactions flow through a hub and spoke system with the master company as the hub. Because of the hub and spoke setup, master companies are only useful if you have three or more companies. The master company could be a real company, or it could be a holding company that is only used for routing transactions. Companies are also where you define the default taxes on all invoices and whether VAT is collected. |

...

Taxes specified on a company are automatically added to your invoices.

When VAT is enabled on a company it is only available to VAT Enabled Resources.

...

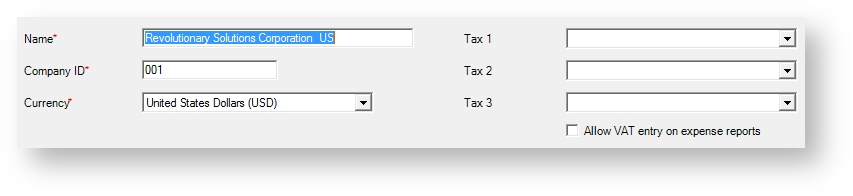

These general settings are found at the top of each company that you edit.

| Field | Description |

|---|---|

| Name | Give the company an identifying name. This name is displayed in Projector reports. |

| Company ID | Give the company a unique code. You can use this code in reports or web services as a unique identifier in case the name should ever change. |

| Currency | Choose the currency that this company's books are kept in. If you don't see your currency, add it using the Currencies and FX Rates Editor. You cannot change the currency if there are any cost centers associated with the company. Such a change would affect the GL currency of any time or cost cards associated with those cost centers. |

| Taxes 1-3 | Specify up to three taxes that will be automatically added to invoices created for projects under this company. If you don't see your taxes, add them using the Tax Type Editor. |

| Allow VAT entry on expense reports | Although this field is titled "Expense Reports" it really applies to all Expense Documents, including Vendor Invoices and Soft Costs. Expense documents that have a disbursing cost center that belongs to a VAT enabled company will have fields for entering VAT in both Expense Entry and in expense document editor screens. |

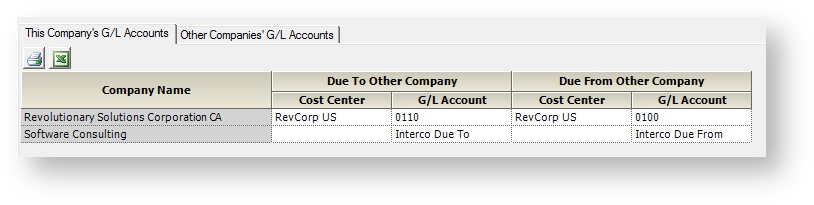

This Company's G/L Accounts

The fields shown on this tab represent the accounts of the company that you are currently editing. Before you fill out these fields, make sure you have decided whether you want to use a master company. If you have chosen to use a master company, then the available fields change. Non-master companies will only show fields to map to the master company. Master companies will show fields to every other company.

| Field | Description |

|---|---|

| Due To Other Company | The Cost Center and G/L Account number used to hold amounts that the company you are currently editing owes another company. |

| Due From Other Company | The Cost Center and G/L Account number used to hold amounts that other companies owe this company. |

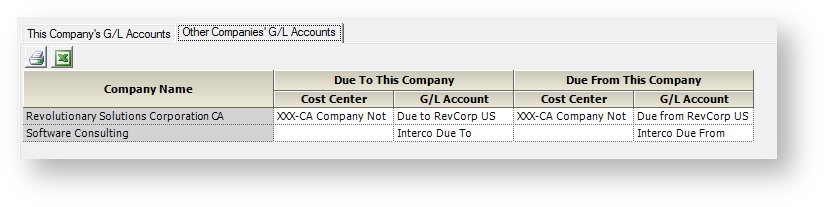

Other Companies' G/L Accounts

The fields shown on this tab represent the accounts of the other companies in your installation. Before you fill out these fields, make sure you have decided whether you want to use a master company. If you have chosen to use a master company, then the available fields change. Non-master companies will only show fields to map to the master company. Master companies will show fields to every other company.

| Field | Description |

|---|---|

| Due To This Company | The Cost Center and G/L Account number in the other company's books used to hold amounts that the other company owes the company that you are editing. |

| Due From This Company | The Cost Center and G/L Account number in the other company's books used to hold amounts that this company owes the other company. |

Accounting

This section will expounds a little deeper on exactly which accounting transactions occur when you make use of a master company and when you don't make use of a master company. When transactions occur that need to cross intercompany boundaries - for instance, a UK employee travels to France and works for your French subsidiary. An intercompany transaction needs to occur in order to reimburse that employee for his travel expenses. In this situation, the AP transaction occurs in the UK company in GBP and an offsetting expense transaction happens in the French company in Euros. To make the transactions balance out, intercompany accounts are used in the following manner:

...

By forcing all intercompany transactions through a master company, each company needs to maintain an intercompany account only to and from the master company, instead of having to maintain a pair of accounts with every other company within the organization.