...

The second permission is to add the tax to an invoice. Anyone who can edit an invoice can add the taxes.

...

Now that you have your tax types set up, it is time to apply them to your invoices. Start by opening an existing invoice. In the Invoice tab, you can apply up to three taxes.

...

Below, please find a few simple examples of how you might collect VAT for a prepayments. Let's assume a 10k prepayment and 2k of VAT.

| Prepayment Scenario | Description | Prepayment Invoice | Real Invoice |

|---|---|---|---|

| No VAT | Don't collect VAT on the prepayment and instead collect it on your real invoice | €10k prepayment | Invoice for €10k of time and cost, client receives an invoice for €2k VAT |

| Prepay VAT | Increase your prepayment amount to account for VAT, but don't actually apply VAT | €12k prepayment | Invoice for €10k of time and cost, €2k of VAT, and consume the entire prepayment. Client owes nothing. |

| Collect VAT | If you do choose to collect VAT up front, you'll need to account for this on the real invoice. | €10k prepayment + €2k VAT | Invoice for €10k of time and cost and no VAT. Client owes nothing. |

The above examples are very much simplified and assume that you charge the client the exact prepayment amount. If you should come under the prepayment amount, or go over the prepayment amount, you'll need to account for this on your invoices. For example, you collect €2k of VAT for €10k of work, but you end up doing €20k of work. Did you collect the proper amount of VAT on the extra work?

...

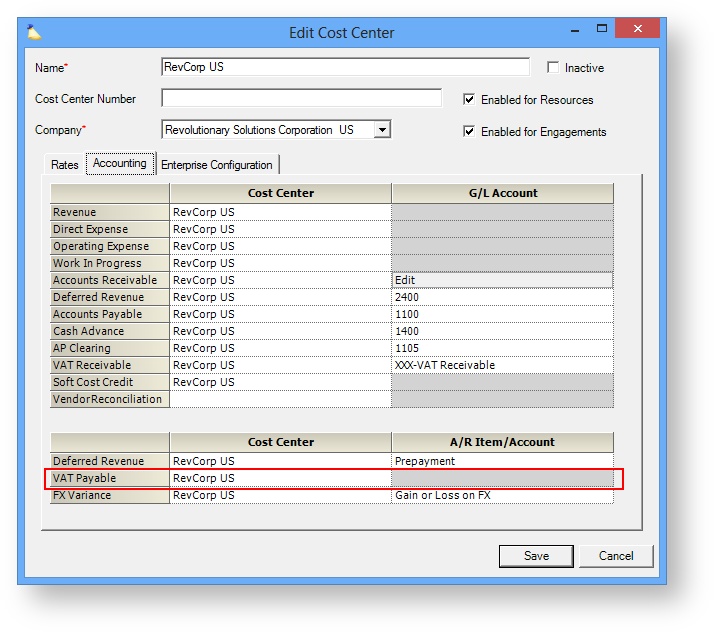

Projector tracks collected VAT at the cost center level with the field VAT Payable. VAT is allocated to this account when an invoice is issued. It is then pushed to your accounting software as a GL entry. The cost center is determined by the engagement's cost center.